Study recommends state-sponsored airline to reduce fares

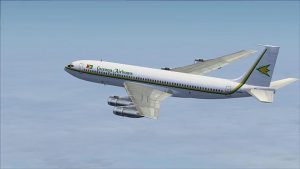

The Competition and Consumer Affairs Commission (CCAC) conducted a recent study on the airline industry and it has recommended Guyana has its own state-sponsored airline.

A study has called on Government to consider sponsoring its own airline to protect travellers from high prices.

The CCAC disclosed that the study was designed to gain insight into the operations of the Georgetown/North America route.

Flights, especially those to New York and Toronto, have been in high demand, with thousands of Guyanese living there.

Ticket prices for economy have touched almost US$1,700 in the past, with travellers calling for other carriers.

In recent months, American Airlines started competing against Trinidad-controlled Caribbean Airlines on the New York route.

Eastern Airlines, which has emerged from the financially troubled Dynamic Airways, is due to start on the route soon, and Jet Blue may also be coming to the market.

According to the CCAC study, the constant stream of players entering and then exiting the market serves as an indication that barriers to entry are not prohibitive.

“The exit of these firms places the citizens in a predicament. We essentially have one player that acts amonopoly, for some of our most demanded routes. The citizens are forced to pay exorbitant prices.”

The report recommended that Guyana temper this monopoly by commissioning its own state-sponsored airline.

“While a state-sponsored enterprise would have its own drawbacks to competition, we have to ask our self what do we prefer – a virtual monopoly, wait another decade for the market to regulate itself which it was trying to do the last decade, (or) sponsor a firm to provide a reprieve to our exhausted citizenry.”

The report pointed out that while this may not be the perfect solution, one must not forget that Caribbean Airlines Limited (CAL) is also a state-sponsored entity.

“The venture may be prone to all the ills of state-sponsored enterprise but if managed properly, we can ensure that there is competitive pressure for the incumbent firms to perform. There is no need to invest heavily in permanent fixtures or to have a permanent presence in the market.”

It proposed that the Government could lease the airplane for a five-year probationary period and service only the most traversed routes.

“After the probation period, the venture could be assessed, and if is proved that it was successful, if there are other competitors, the company can then exit the market. Guyana will be looking to invest its huge amount of expected revenues, from oil production; it may be prudent to consider to invest in a national airline.”

According to CCAC, in its summary of the report, Guyana’s population for a number of years has been estimated to be just around 750,000 – never having grown or declined significantly.

It pointed to the huge number of Guyanese who live overseas, which also mirrors the population.

Guyana tourism statistical digest for 2016 indicated that for the years 2013, 2014, 2015 and 2016 the number of visitors to Guyana were 200,060, 205,824, 206,819 and 235,312.

“The data illustrates that for 2017 the number of visitors approximate 250,000. These figures do not include residents of Guyana that travel internationally. When we do include those figures the number of passengers arriving in Guyana for 2016 is 500,000. The majority of these visitors utilize airline services to travel to Guyana, as other methods of international transportation aren’t as widely used, e.g. via land and sea.”

The 28-page study said that according to an Oxford Economic Report on Aviation in Guyana, “the economic impact of the aviation sector in Guyana is substantial. The most direct activities associated with aviation create $20.7 billion in annual economic activity. This represents 3.2% of Guyana’s total GDP in 2015.”

Moreover, nearly 12,000 Guyanese jobs are supported by the aviation industry -the majority in either transportation or tourism.

“This accounts for nearly one in twenty jobs in Guyana. Air passengers also generated roughly $1.7 billion in travel tax revenue for the government.”

The report stressed that pricing in the airline industry is a dynamic affair.

“Pricing for a route is determined by a number of factors such as demand, cost, competitors, type of consumer (leisure or business), substitutes and types of carriers in the market.”

CCAC said that it is because of the impact that this sector has for the nation that it wanted to take stock of the industry.

“We were seeking insight into the holistic operations of the industry, we sought to understand the entry requirements for airlines, operating costs, and challenges faced by airlines, why there is a lack of competition, and essentially why the industry operates the way it does.”

In preparing the report, the Commission disclosed that it gathered data from market players including the airlines, the tourism authority and Guyana’s regulatory body, the (Guyana Civil Aviation Authority (GCAA).

“Data was supplemented by interviews with both CAL and GCCA. We also gathered raw passenger data from the U.S. Department of Transportation and CJIA along with the Joint Select Committee on State Enterprises report into the Administration and Operations of Caribbean Airlines Limited.”

CCAC said that during the investigation, it found that while the industry is indeed an inherently competitive industry, significant barriers to entry exist in the form of financial barriers and industry expertise.

“In Guyana, entry into the market was quite easy, as the other barriers such as regulatory and institutional barriers were quite low, so as to attract investment in the international industry. These low barriers to entry into Guyana can be illustrated by the steady influx of new competitors over the last decade.”

The report said that it was found that CAL, which essentially had a monopoly over the GEO-JFK route, was the dominant market player with just about 59% of total CJIA traffic in 2018, its market share declining over the course of the years.

“Previous academic research does confirm that a competitor in this industry will keep prices down.

We also estimated that a conservative breakeven price for an airline operating at 78% seat capacity at the GEO-JFK one way to be 173USD (tax free) and the return price to be 346USD (tax free).

We recognize that there is a need for one other competitor flying the GEO-JFK route in order for consumers to derive tangible benefits not only in price but other non-price services.”

The report predicted that one can expect there to be fierce price and non-price competition for routes where there are two or more competing players.

CCAC, established in 2006 and fully operational in 2010, functions in executing the laws governing two acts – namely the Competition and Fair-Trading Act No. 11, 2006 (CFTA) and the Consumer Affairs Act No. 13 2011 (CAA).

Guyana had its own airline – Guyana Airways Corporation (GAC) – which folded almost two decades ago, after serving Guyana for almost 60 years. Since then, CAL which morphed from BWIA, has been around, servicing the high-demand North American market.

A number of charter operations have come and gone, including Dynamic, EZJet and Continental.