Guyana agreed to lose billions on pre-contract, interest costs, while Suriname says ‘not here’

Guyana’s leaders are so determined to grant extremely generous fiscal terms to oil companies, that they have agreed to forfeit billions of United States dollars, which could have gone to housing the homeless, making college education free, and erecting state-of-the-art hospitals.

Two of those generous concessions include an agreement to pay oil companies uncapped interest rates on loans they (the oil companies) take to fund petroleum operations offshore Guyana and an agreement to repay these companies for “pre-contract costs.”

Guyana’s neighbour to the east, Suriname, has done a much better job of securing the value in the prolific basin that these two countries share.

Suriname’s model Production Sharing Contract (PSC) explicitly states that pre-contract costs and interests on loans are not recoverable.

In the Accounting Procedure of the Suriname model PSC, it is stated that “costs incurred before the Signing Date including the purchase of seismic data” and “Interest incurred on loans raised by the Contractor” do not qualify for cost recovery.

Suriname’s Staatsolie said that its PSC is world-class. Guyana’s contracts have gone in the other direction.

Guyana’s hefty pre-contract costs

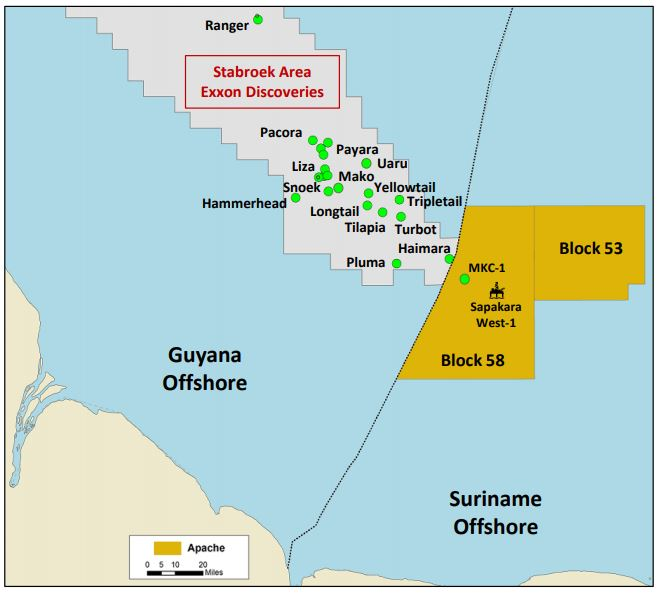

There are pre-contract costs under several agreements with oil companies operating offshore Guyana. The heftiest pre-contract cost is for the Stabroek Block agreement, including costs owed to ExxonMobil.

Section 3 of the Accounting Procedure of the Stabroek Block agreement lists many expenses recoverable by the contractor. Included in these are “all such costs incurred under the 1999 Petroleum Agreement between January 1, 2016 and the Effective Date which shall be provided to the Minister on or before October 31, 2016 and such number agreed on or before April 30, 2017.”

This includes the US$460M stated in the contract and an additional amount not made public by the Government. International lawyer, Melinda Janki, estimated that the additional cost would take the total pre-contract cost to US$960M.

These costs include “contract costs, exploration costs, operating costs, service costs and general and administrative costs and annual overhead charge as those terms are defined in the 1999 Petroleum Agreement,” according to the 2016 contract.

There are pre-contract costs under several other contracts. Unlike the Stabroek Block agreement, a number of these agreements don’t even define pre-contract costs, leaving the public to wonder what it is paying oil companies millions of dollars for.

Interest costs to be paid to Exxon could amount to billions

The Accounting Procedure of the Stabroek Block agreement allows the contractor to recover “Interest, expenses and related fees incurred in loans raised by the parties comprising the Contractor for Petroleum Operations and other financing costs provided that such expenses, fees and costs are consistent with market rates.”

Darshanand Khusial of the Oil & Gas Governance Network had explained last year in a letter, that a failure to define “market rate” in the contract could lead to Guyana having to fork out billions of US dollars in interest payments alone.

As the PSA is currently structured, there is no cap on how much of that interest can be recovered.

Interestingly, “Agreed Interest Rate” is clearly and precisely defined on page 3 of the Contract, but not “Market Rate.”

“Why would the oil companies want to avoid giving a precise meaning to ‘market rate’?” Khusial had questioned.

ExxonMobil has an exemplary credit rating, which would allow it to take out loans at a low market rate. But that low rate won’t apply to Guyana, since it signed the PSA – not with Exxon – but with its subsidiary, Esso Exploration and Production Guyana Limited (EEPGL).

Khusial had said that if the repayment of interest on loans would have used the ‘Agreed Interest Rate’ as defined in the contract, the rate would have been three percent had the agreement been signed with ExxonMobil. At the time of Khusial’s analysis, the estimated recoverable resource in the Stabroek block was six billion barrels. Using simple projections to determine the cost to produce all 6 billion barrels, Khusial had calculated that that would grant ExxonMobil an extra US$1.7B. That US$1.7B would apply for ExxonMobil, which is considered “low risk.”

“But Esso… would be classified as high risk. If one checks the market rates of bonds issued by Exxon, you can find the yields of around 2%. But what rate would Esso… be charged for its loan?” Khusial had questioned.

He explained that it is unlikely Esso would even be able to get a large loan on the market, but this is where Exxon can leverage its good credit rating. Exxon can simply loan the money to Esso, essentially allowing the oil major the advantage to manipulate the interest rate.

Khusial had pointed out small, risky companies, which pay market rates of 30 and 18 percent respectively.

He had calculated that a 15 percent difference in the market rate could mean Guyana forks up an extra US$8B, and that a 30 percent difference would cost the country an extra US$16B. Khusial had said that this provision was likely carefully planned by the oil companies. Between the time of publication of Khusial’s letter, Stabroek block proven reserves jumped three billion barrels. That’s an extra US$4 – US$8 billion in interest alone, under the Stabroek block agreement alone.