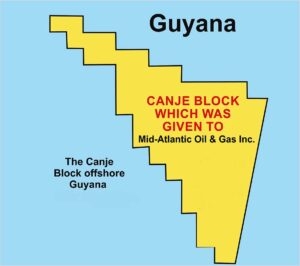

GGMC knew initial Canje owner was penniless, but gave it the block anyway

Secret documents from the Office of the President have revealed that the Guyana Geology and Mines Commission (GGMC) knew Mid-Atlantic Oil and Gas was broke; that it could not finance its work commitments under the Canje agreement, but gave the ultra deepwater block away to the company anyway.

Mid-Atlantic was so broke that it did not even have a seismic survey done before it started to flip the licence – let alone, have the money to drill a well.

The GGMC admitted that Mid-Atlantic on its own could be seen as a company that is insufficient to finance work in the block, and wanted a commitment that the company would somehow get the money.

It explained, to the question of giving an oil licence to a new company without financial statements, that the critical consideration is at least making sure that the company could make it past the first stage of the work programme. In the case of the exploration licence, that would be a seismic survey.

Commissioner Newell Dennison did not see raising enough money for such a task as being a problem. He said that if it ended up being that the owner couldn’t find the money, the licence would later be withdrawn.

So GGMC agreed under the contract that Mid-Atlantic would seek to raise finances in the market for its operations while it held the licence. However, GGMC did not actually expect Mid-Atlantic to raise the finances.

The regulator advised its subject Minister, Robert Persaud, to recommend the award be made to Mid-Atlantic because it considered Chief Executive Officer of JHI Associates, John Cullen, as the person with the capability of raising the finances needed to do the work.

Dennison explained, according to the documents, that Cullen’s history with CGX is what led the regulator to assume that securing finances would not be a problem. The Commission regarded Cullen as a “formidable” partner in securing capital for projects, and it had received a communication from Cullen and/or JHI.

Cullen and Mid-Atlantic shareholder, Edris Dookie, are the co-founders of CGX, but CGX was not involved in the application for the Canje block. Neither were the two men still with CGX at the time of the application.

Further, Cullen was not part of Mid-Atlantic.

This newspaper revealed last week that the Canadian JHI had completed a farm-in agreement in 2014 for the Canje block with Mid-Atlantic, before Mid-Atlantic even received it. The two companies appear to have been planning this for years.

GGMC was aware of this. It knew that there would eventually evolve some mechanism for Cullen’s interest in the Canje block to emerge, and was aware of the 2014 arrangement reached between the two companies.

So when Guyana granted the block in 2015, as per their agreement, Mid-Atlantic allowed JHI to become a legal owner of the block on May 15, 2015 – weeks after the award, and days after the general election.

There was no issue with this transfer getting the approval of the government, as the government gave the block away on the condition of JHI’s involvement.

GGMC was satisfied that Mid-Atlantic would amass the technical competence needed to do the work, as it regarded Dookie’s time with CGX as proof enough that he could develop the capacity of the company.

Together, JHI and Mid-Atlantic held on to the block for a year, and then sold a 35 percent interest and the operatorship to ExxonMobil in 2015. Then, in that year, a seismic survey was done.

JHI and Mid-Atlantic also sold a 35 percent stake to Total SE in 2018.