CGX to bill Guyana US$155M for one dry well on Corentyne block

Following its first discovery of significant amounts of hydrocarbons at the Liza well in the Stabroek Block, American oil giant, ExxonMobil quickly put Guyana on notice that it is owed US$450M in exploration costs. The oil giant claimed that these costs were incurred from the time it was awarded the licence by the Janet Jagan administration in 1999 up to the time it made the commercial discovery in 2015.

After it made this known, ExxonMobil and the Granger administration negotiated and signed a lopsided Production Sharing Agreement in 2016 which essentially laid out favourable provisions for the company. Between 2015 and 2016, ExxonMobil said that Guyana has to pay additional costs it racked up. Guyana ended up owing ExxonMobil approximately US$900M before a drop of oil was pumped and the country is yet to verify these costs.

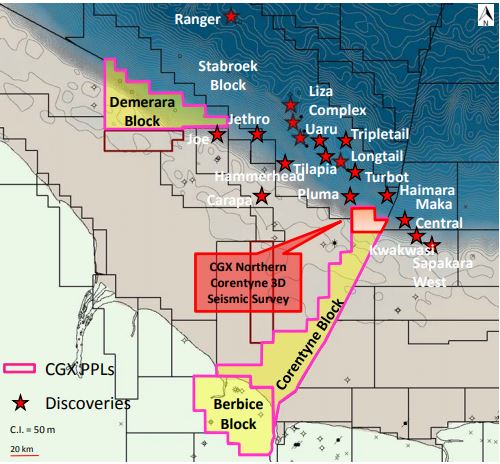

Following an examination of the latest financial statements of CGX Resources Inc., it is clear that this exploration company is poised to do exactly what ExxonMobil did to Guyana, should it make a commercial discovery on its Corentyne block. According to the company’s quarterly financial statements for the period ended June 30, 2020, CGX noted that it will recover US$155,000,000 against any future commercial production. Importantly, CGX said that these costs are “brought forward from the original Corentyne licence.” The company’s latest financial report notes that the original Corentyne petroleum agreement was awarded in 1998, following which, the company began an active exploration programme consisting of a 1,800 km seismic acquisition. This was in preparation to drill the Eagle well.

CGX noted that the Eagle drilling location in 2000 was 15 kms within the Guyana-Suriname border. However, a border dispute between Guyana and Suriname led to the company being forced off the Eagle location before drilling could begin. As a result of that incident, CGX said that all active offshore exploration in Guyana was suspended by CGX and the other operators in the area, including Exxon and Maxus (Repsol, YPF).

On September 17, 2007, the International Tribunal on the Law of the Sea (“ITLOS”) awarded a maritime boundary between Guyana and Suriname. CGX was keen to note that it financed a significant portion of Guyana’s legal expenses but this only came up to US$9.8 million. The decision was beneficial for CGX, as it concluded that 93% of CRI’s Corentyne block would be in Guyana territory.

After the matter was settled in 2007, CGX moved to acquire 3D seismic in Guyana to enhance its interpretation of its newly defined Eagle Deep prospect, a large stratigraphic trap in the Cretaceous zone. The cost of the seismic programme was approximately US$8 million. Processing and interpretation of the 3D seismic data was completed in 2009.

Based on the interpretation of the 3D seismic volume and concurrent activities on both sides of the Atlantic margin, the company interpreted numerous prospects on the Corentyne block. The company went ahead with the Eagle-1 well and drilled same on February 13, 2012. That well was later declared a dry hole.

In November of that year, the company was awarded a new Petroleum Licence for the Corentyne Block.