Canje Block may be more valuable than Stabroek Block

The Canje Oil Block is estimated to hold 10 billion barrels of oil in just over a dozen prospects to be drilled, with drilling expected to begin in the next six to nine months. With these prospects, the Canje Block may turn out to be more lucrative than the Stabroek Block.

The revelation was made in the Annual Report and Audited Financial Statements (as of 30 June 2020) of Westmount Energy Limited, an investment firm with indirect interests in several of Guyana’s offshore blocks.

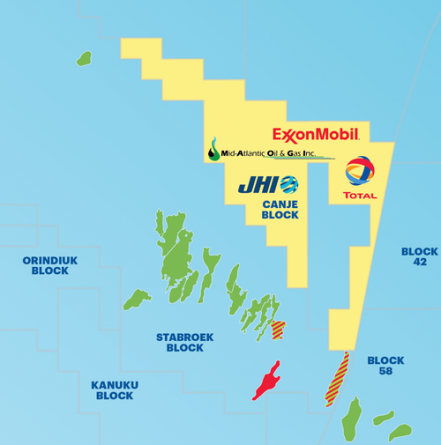

Westmount’s interest in Canje is through its 6.9 percent of issued shares in JHI Associates. JHI is a Canadian-led company that has a 17.5 percent stake in the Canje block.

“The block is reported by JHI,” Westmount stated, “to contain more than a dozen prospects in the Canje portion of the Liza play fairway, representing more than 10 billion barrels of prospective recoverable oil resources, with a number of the prospects exhibiting the same DHI (Direct Hydrocarbon Indicator) characteristics as the neighbouring Stabroek discoveries.”

ExxonMobil has, over the last six years, made 18 discoveries amounting to nine billion oil equivalent barrels, less than what is expected to come from the just over a dozen prospects in Canje. To put that into perspective, Exxon’s tenth discovery in the Stabroek block had taken its estimated recoverable resources to five billion oil-equivalent barrels.

Westmount said that subsequent processing and interpretation of data has granted the Canje Block co-venturers a substantial inventory of prospects, starting with Bulletwood, Jabillo and Sapote. The 2018 Competent Person Report including the results of the data processing, was reportedly done by the Texas-based firm, DeGoyler McNaughton. It is not publicly available.

The 3D seismic survey was done by the operator of the block, ExxonMobil, in 2016.

JHI anticipates that the first planned well in Canje, Bulletwood-1, will be spudded this month or the next.

“The Bulletwood-1 prospect is reported to be a ‘Liza look-alike’ confined channel complex,” Westmount said.

It is expected to contain about 500 million barrels.

“The second well on the Canje Block will target either Sapote-1 in the east of the block or Jabillo-1 in the northwest of the block, which is reported as a billion-barrel class basin floor turbidite fan.”

The Canje Block was awarded to Mid-Atlantic Oil & Gas in March 2015. In just two months, that company started transferring stakes to other companies, starting with JHI Associates, with which it came to an agreement in 2014, before it received the block.

The next sale was to ExxonMobil, which became the operator in 2016. A stake was also transferred to Total SE in 2018. In 2019, ExxonMobil relinquished a portion of the block to the government as per the terms of the exploration licence, reducing the size of the contract area from 6,100 sq. km to 4,800 sq. km.